- Home

- News

- Interviews NEW

- Vacancies

- Editor's Preface

- Ukrainian Legal Market

-

Practice Areas and Industries Review

- Administrative Disputes

- Advertising & Marketing

- Agribusiness

- Alternative Dispute Resolution

- Anti-Corruption

- Antitrust

- Asset Tracing

- Aviation

- Banking & Finance

- Banking Disputes

- Bankruptcy

- Business Crime

- Business Immigration

- Business Process Solutions

- Business Protection

- Capital Markets

- Commercial Law

- Competition Investigations

- Compliance

- Contract Law

- Copyright

- Corporate

- Corporate Disputes

- Counterfeiting & Piracy

- Criminal Process

- Cross-Border Debt Restructuring

- Currency Regulation

- Data Protection

- Defense

- Dignity and Reputation Protection

- Due Diligence

- E-Commerce

- Energy

- Energy Efficiency

- Enforcement of Foreign Awards

- Enforcement Proceedings

- Factoring

- Family Law

- Financial Restructuring

- Fintech

- Fraud

- Gambling

- Hospitality

- Housing & Communal Services

- Ico

- Industrial Parks

- Infrastructure

- Insurance

- International Arbitration

- International Civil Procedure

- International Finance/Eurobonds

- International Tax

- Internet

- Investigations

- Investments

- IT Law

- Labor & Employment

- Land

- Lease

- Legaltech

- Litigation

- Marine Insurance

- Maritime Law

- Medicine & Healthcare

- Mergers & Acquisitions

- Migration Law

- Natural Resources

- Parliamentary & Public Affairs

- Patents

- Ports and Marine Terminals

- Private Clients / Wealth Management

- Privatization

- Procedural Actions

- Procurement Disputes

- Project Finance

- Public Private Partnerships

- Public Procurement

- Real Estate

- Regulatory

- Renewable Energy

- Role of Experts in International Arbitration

- Sanctions

- Secured Transactions

- Show Business

- Sports Law

- State Aid

- Tax

- Tax Controversy

- Telecommunications

- Trade Remedies

- Trademarks

- Transfer Pricing

- Transportation

- Unfair Competition

-

Who Is Who

- Agribusiness

- Antitrust and Competition

- Banking & Finance, Capital Markets /Debt Restructuring

- Bankruptcy

- Corporate and M&A

- Criminal Law / White-Collar Crime

- Energy & Natural Resources

- Infrastructure

- Intellectual Property

- International Arbitration

- International Trade: Trade Remedies/WTO, Commodities, Commercial Contracts

- IT / Telecommunications & Media

- Labor & Employment

- Litigation

- Pharmaceuticals / Medicine & Healthcare

- Real Estate, Construction, Land

- Retail

- Tax and Transfer Pricing

- Transport: Aviation, Maritime & Shipping

- Law Firms Profiles

- Lawyers Profiles

- Archive

Reaching Convenience

Research 2018: Scoping Rules

Being published since 2003, Ukrainian Law Firms. A Handbook for Foreign Clients (widely quoted by the market by its abbreviation — ULF), has become the most comprehensive resource for legal service providers and their customers.

This presented and thorough piece of research is the result of analysis of corporate submissions, individual feedback by practice areas and industries, interviews by phone and one-to-one meetings, as well as available open sources, plus consistent monitoring of the market. If a firm didn’t provide us with corporate submission, and there was no available information in public sources, a firm/lawyer was not able to enter ranking tables.

We traditionally single out practices and industries relevant for the current developments in the legal market. These multipractice areas are represented by the rankings of law firms only.

The practice of international trade received an additional segmentation, and is now supplemented with a listing of firms dealing with commercial contracts.

We continue to follow our traditional shortlists methodology, and significantly advanced in researching the mid-market and law firms with substantial regional focus. Moreover, we monitor international counsels that work on matters involving Ukraine in a precise fashion.

The current Handbook contains 19 surveys and 27 rankings.

The methodology is based on a combination of criteria, including first and foremost, presented projects for the period of 2017 (research period), complexity of matters, client profiles, practice diversity, team capacity, reputation.

In the previous edition we introduced the category of “Other established practices”

(firms possessing accomplished teams, human capacities, track record over the research period, peers’ reference and expertise recognition). It helped us to reveal a broader market landscape and analyze the dynamics of development of law firms, observe changes of market structure, provide you with a more precise view on different competition tiers.

With the further development of the market we continue to single out market authorities. These are practitioners with stunning reputations as leaders, luminaries, establishing certain standards of work, and constantly referred to as founders and trendsetters of certain practices. Some of them are currently occupying positions of managing partners and are active in areas of reforms.

In certain practice areas, where the legal market has developed rapidly, we extended shortlists (for example, energy, real estate, banking and finance, litigation), and vice versa, where the practice is rather niche and divided between several participants, it was shortened (e.g., international trade, port infrastructure).

IN FOCUS: LVIV

Anton Podilchak, Managing Partner, Advice Group

“Multi-tasking and multi-specialization are the core competitive advantages of regional counsels in Lviv”

What is the influence of your proximity to the EU on the legal market of Western Ukraine? Can you name three distinctive features of the legal landscape?

Proximity to the EU definitely influences the local business environment foremost in a philosophical approach, by setting up significantly different from the rest of Ukraine mindset, values and practices.

I would say there are two key reasons for that — first is the global mobility of Western Ukrainians, having more ties to Europe via travel, work and living experience of their own, or their relatives abroad, which is actively implemented upon their return home. Second is the active engagement of small and medium businesses from Western countries on the local market, while they come, they bring their best practices, inclusive — paying lawyers also for work, not only for solutions.Among distinctive features I would name is the free spirit of people — motivating for litigation and dispute resolutions at all levels of the social environment, starting with legal fights over five square metres of land, right to use the playground, etc., all the way to corporate disputes and administrative fights against bureaucracy. Secondly, foreign business created a hi-end compliant legal market but with a very thin spread for high density of professionals to compete for the client, meanwhile the mid-level service drops out of the game, leaving just traditional “one-man-show” attorneys for the rest of the market. Thirdly, all firms de facto declare a high level of integrity and anti-corruption, but only a few of them really fulfill that declaration, leaving a great deal of litigation to be taken to the Supreme Court. It also worth mentioning that due to the high level of competition and little work to be revised, the local legal culture has been raised to a brand-new level, striving for de facto establishment of the rule of law, respect towards human dignity and fair play. Fourthly, law firms in the region are usually more involved in the local everyday life of a community, cooperating deeply with NGOs, local authorities, representing the expert legal opinion on drafting local regulations, organization and participation of local events for businesses and other stakeholders.

What is the source of clients for regional law firms?

Firstly and best of all, word of mouth! Existing satisfied clients are the best referral generators. Another point of reference is the EBA and local authorities dealing with foreign investors. Good clients also come from diplomatic circles quite often. We also have a good practice of “direct sale” via meeting potential clients at foreign business events or directly at their offices.

Where does the competition come from? What are the core competitive advantages of regional counsels in Lviv?

Competition in the region is rooted in a limited market and a great amount of legal resources: law firms tend to fight for a big client, who is normally a foreign investor and/or big firm with a long local history. We believe that within the regional legal market the multi-tasking and multi-specialization are the core competitive advantages of regional counsels in Lviv. With a limited amount of time, a regional counsel accomplishes a bigger amount of qualitative legal services than a universal legal professional representing him/her. We also believe that local councils are often more into detail-inspired solutions due to proximity to the client and low load.

Following this approach, in practices where shortlists either of firms or individuals were inappropriate due to practice specifics or insufficient data, we produced the list of notable firms and individuals in alphabetical order for your convenience.

In response to practice developments, we have prepared a new survey on Infrastructure, with the Ukraine-wide ranking, and port infrastructure presented by Odessa-based regional law firms in the way we have seen the market in 2017. Another specific niche area we highlight separately is aviation finance, which has been overviewed in the transport survey. The transfer pricing overview is supplemented with the listing of firms that operate in this area.

The most comprehensive information on deals for a year-long period could be checked in Tables 1-5.

Influx of Transformations

Macroeconomic stabilization and enforcement of several reforms in the country determined a certain uptick in business activity. The legal market continued to show a slow but confident revival, improving performance especially in transactional work.

Many market players consider the past year a year of transformations.

Competition is getting tougher from year to year. But this time we have an interesting observation that this statement is relevant for Kyiv and mostly the high-end market. Having investigated the situation in the regions, it is obvious that competition is shifting there towards legal departments. Law firms compete rather to win new clients, instead of hunting for clients of their competitors. Certainly, every region has its particular specifics, which is very useful to understand before doing business there (for more insight we prepared blitz interviews with the managing partners of law firms from Lviv, Odessa, Dnipro and Kharkiv).

The global trend for narrow specialization of law firms is getting stronger. The already recognized role of boutiques has a constant tendency to grow.

In 2017 we have observed two contrary market trends — mergers and splits. Meanwhile, this is a period of growth in the mid-market that is perhaps less public but dynamic and flexible.

Young local firms demonstrate rapid positive dynamics of growth, stepping into competition with renowned incumbents.

The recent level of foreign investment coming into the country is far from desirable figures. This determines the sluggish interest of international law firms in Ukraine, and confident positions of domestic firms on the market. Locals continuously enhance their geographical reach by exploring international legal networks and alliances, adding instructions in certain practice areas, and establishing contacts with other independent firms in other jurisdictions.

Business law firms are rather keen on innovations that disrupt the global legal market. This past year in Ukraine the trend of digitalization became a period of “transforming talk into action”. Some firms are extremely active in this field and launch their own legal tech initiatives. For example, AEQUO, Juscutum, KPMG Law, Sayenko Kharenko, Sokolovskyi & Partners, TCM Group.

Legal tech start-ups encompass solutions for improving service offering, client care products, implementing new approaches in providing legal services through new IT applications and platforms.

International law firms and legal units of the “Big 4” can use their competitive edge to implement global know-how in their outfits on the ground.

Buyers market. Law firms still find themselves under the pressure of clients’ budgets, who seek predictable figures of their spending. The global trend of “more for less” is reasonably relevant for Ukraine. Even more so, not only big clients use tenders and create panels of legal counsels. Mid-market clients also tend to use tenders as a mechanism of legal services purchase. Nevertheless, market insiders confirm that in 2017 legal fees (hourly rates) slightly increased if compared to 2014-2016. Firms invest more money and time to test client needs and consider their feedback. Our private conversations with top law firm leaders confirm that this is a rather routine approach to adjust services to client expectations and it really works to gain loyalty.

IN FOCUS: ODESSA

Alexander Kifak, Managing Partner, ANK Law Office

“In reality all maritime cases are handled between 2-3 law firms based in Odessa”

What are three key features of the legal market in Odessa and Southern Ukraine? How does the economy determine the specialization of regional legal counsels?

I always reiterate that Odessa has a unique geographic location: this is the place of the biggest Ukrainian ports, where the port business is concentrated. Here we have the biggest open air market in Eastern Europe, where about 30,000 individual entrepreneurs do their business. In Odessa and Mykolayiv Regions we have leading Ukrainian wineries, small and middle-size agricultural households. Main Ukrainian shipyards, shipping and crew companies are located in Odessa, Mykolayiv and Kherson. All these factors do have an impact on the legal market in Southern Ukraine. That is why we have strong maritime, port infrastructure, maritime insurance and agricultural practices.

Do you face competition from law firms based in Kyiv or from the offices of international law firms?

It depends what you mean by the term “competition”. For example, last year we noticed that some Kyiv-based law firms declared that they practice maritime law. However, in reality all maritime cases are handled between 2-3 law firms based in Odessa. Nobody finds maritime or port lawyers in Kyiv. Another trend in recent years is that a lot of young and ambitious lawyers resigned top/leading law firms and opened their own practices. We are aware that they propose clients significantly lower hourly rates and sometimes clients give preferences to these offers.

What challenges do you face as a regional firm?

Sometimes the infrastructure project in Southern Ukraine (for example, construction of new marine terminal in the port) is officially supported by a Kyiv-based law firm or international law office, not a regional one, because the final decision on the engagement of lawyers is taken in Kyiv. It is because the headquarters of an international company (the investor) is located in Kyiv or, in the case of legal support for a financing institution, because the EIB, EBRD or IFC decision-makers are sat in London or Washington. In reality Kyiv law offices usually sub-contract work to a regional law firm, who knows the local business climate better and so can be more effective compared with a Kyiv-based or an international law firm. We have a similar situation when a company whose main business is in Kyiv decides to broaden its business to the regions. In that case they prefer to delegate legal work to their “home-based” legal counsel instead of engaging a new law firm based in Odessa, Mykolayiv or Kherson.

Recruitment. This past year the number of open positions in law firms was higher, and announcements of “we are hiring” rapidly returned to specialized sites and social networks. Many law firms confirm that it is a big problem to attract a mid-level practitioner. This is about competition for talents that includes not purely financial motivation. The task is usually resolved by poaching experienced employees from other law firms, and rarely, in-house. Thus, certain market leading firms kept strengthening their practices with strong, recognized lawyers, who reinforced expertise and the market positioning of relevant practices.

Employers are keen to look at soft skills of candidates, drawing attention to the fact that it is hard to get adequate employees in their salary expectations. It is noteworthy that remuneration desires, according to different estimates, increased by 20-30%.

The most noticeable change in recent years is rising demand from the in-house sector. Corporate legal departments may successfully compete for employees in terms of price and career prospects.

With the traditional professional migration of employees there is a visible attempt by law firms to work with their internal and external HR brand. Law firms are getting more involved in the activities in the student community, sponsoring contests, internships, taking part in different educational initiatives. Naturally, the loyalty of these stakeholders is a powerful tool of reputational management.

Partnerships. The migration of partners between law firms continues and rarely

includes personal departures, and more often team transfers. In light of spin-offs and fragmentations over the last couple of years, the partners of law firms are keen to formalize their partnerships for psychological comfort. It adds trust and confidence in partnership relations, providing the terms of “admissions” and “exits”.

Another important trend has been proved by respondents and called a return to Western standards of partnerships, when partners not only manage or sale, but also demonstrate involvement in project work.

IN FOCUS: DNIPRO

Denys Myrgorodskiy, Managing Partner, Dynasty Law Firm

“The region is unprecedentedly saturated with large metallurgical, coke-chemical and machine-building enterprises, which, to a large extent, set the tone for the legal services market”

What sets apart the Dnipro market from the rest of the country?

The Dnipro regional market has always been quite specific. Four business clusters belonging to different national and religious cultures coexist peacefully enough here. Apart from local Ukrainian business groups, of which about 40 are representatives of large business, and thousands more are medium and small ones, there is a significant presence of large international companies, as well as businesses of Jewish and Turkish origin. Among international companies, which chose Dnipro as the location for their head offices, are heavyweights like Danieli Heavy Machinery, LindeGaz, Primetals technologies, East Bolt, Sitecore, production sites of international groups ArcelorMittal, Procter & Gamble, Retal, Bunge, etc. are also located here.

Jewish businesses, centered around a large and well-managed Jewish community, are very diverse and deserve a separate story. The Turkish segment is represented by Limak office and a group of production enterprises of Turkish holdings — Axor, Miroplast, UDK, as well as by representative offices of Turkish traders and retailers.

Thanks to the region’s proximity to deposits of metallic ores, it is unprecedentedly saturated with large metallurgical, coke-chemical and machine-building enterprises, which to a large extent set the tone for the legal services market.

How would you comment on the situation on the regional legal market? How is it affected by its proximity to the occupied territories?

Over the last year the legal market has been demonstrating a significant shift from routine business support projects and solving challenges faced to development projects: acquisition of equipment, businesses, investment in new assets. The number of legal studies, conducted by us at the request of potential business purchasers and investors for the first quarter of 2018, exceeded the number of such projects for the whole of 2017. Unfortunately, the number of registered criminal proceedings on economic crimes is also on the rise.

The proximity of occupied territories certainly affects the market: criminal lawyers are regularly hired by clients involved in cases of offenses against the state and of military service, which were extremely rare earlier. Business advocacy has felt a significant shift in the interest of foreign investors towards opening new production facilities in Western regions of the country: from 2015, three or four production units have been unveiled by investors in the West against one in the East of the country. On the other hand, one good piece of news was the inflow of small clients and qualified personnel from the occupied territories.

Do you cooperate (on a referral basis) with other law firms? What is the role of the office in Kyiv?

Many metropolitan law firms are well aware of the strong positions of our office in Dnipro and constantly turn to us for assistance in projects related to Dnipro and Zaporizhzhya Regions. There can be 3-5 such

projects pending at the same time. We see them not as a considerable part of our orders, but rather as fraternal assistance to brothers in trade. In many cases, large Ukrainian and international law firms send the client with interests in the region directly to our office, realizing that we are well aware of regional specifics and will be able to provide more efficient assistance. Referral partners of such level are rarely interested in a referral fee, much more often they are driven by concern for the interests of the anchor client and desire to provide the most qualitative assistance.In general, the viewpoint that regional offices and firms should be more focused on orders from metropolitan law firms, which I sometimes hear from consultants in the area of legal business development, is deeply flawed. As a rule, it comes from people who have never developed a legal business in regions.

A firm with a full range of services can successfully develop only in one case: when it builds direct relations with its client, whether with regional elites or multinational companies. Our office in Dnipro has a number of direct agreements with large multinational companies, which have other legal counsels in Kyiv. Alternatively, the Kyiv office serves clients from the eastern part of the country that are not clients of the Dnipro office. But relationships with a client remain direct in any case.Our offices in Dnipro and Kyiv have a clear distribution of functions on a geographical basis.

The projects and instructions of clients with their place of execution in Dnipropetrovsk, Donetsk, Luhansk, Zaporizhzhya, Kirovograd, Kharkiv, Poltava Regions of Ukraine are supported by the Dnipro office. The remaining projects are, as a rule, supported by the office in Kyiv. Exceptions can be made due to the special affection of the client to a professional or a group of professionals, whose opinion he or she particularly trusts and wants to see in a particular project; or because of the narrow area of expertise of the associate, which is required by the client’s instruction.

Areas of Dynamism

The trend of previous years has continued, and dispute resolution remains the core practice in generation of income by law firms. This is explicitly illustrated by the breakdown of aggregate turnover of top 50 law firms in 2017 by practice areas (see Figure 1).

With the lack of confidence in Ukrainian courts, big Ukrainian business prefers to resolve commercial disputes in foreign jurisdictions, first of all in the UK. This triggers cross-border litigation and international commercial arbitration.

The statistics provided confirm that corporate and M&A, including distressed assets sale, tax, banking, financial restructuring, insolvency and bankruptcy are strategically important offerings on the legal market.

The industrial breakdown of turnover (see Figure 2) reveals that the banking sector still constitutes a significant share of income.

IN FOCUS: KHARKIV

Tetyana Gavrysh, Managing Partner, ILF Law Firm

“The client wants faster, cheaper and more efficient work”

How would you describe the recent legal market landscape in Kharkiv and the broader region? Do you find it sufficiently competitive?

The Ukrainian legal market as a whole is rather latent, and Kharkiv is no exception. After all, on the surface, in the public plane, a client can only see the top 50 law firms from the annual national ratings of the same name. If we take a look at the projects of these companies, they deal mostly with big business, major transactions and disputes. However, it is very difficult to name those who work with the mid-market — rapidly growing medium businesses and startups. According to the Legal Practice and personal observations, 80% of regional markets are represented by independent lawyers. This is not just regional statistics, it is a global trend. Law firms are reconsidering their traditional model, the so-called BigLaw, and are moving on to NewLaw: remote workplaces and marketplaces — which is essentially outsourcing projects to lawyers.

In regional markets, competition often revolves around the price: who will ask for less (and it’s not just the regional players trying to undercut others, but national ones as well — competing for projects of large regional clients). However, this does not take into account the big picture and such legal business is, in my opinion, not sustainable, since there will always be someone selling services for less than you.

The future belongs to another type of competition: that of recognizable brands (both personal and or corporate) that are beneficial to the client, and of competitive products. Here, it is not the price that matters, but rather the actual value of the product for the client.Do you see any region-specific trends in legal practice there?

We know several large national law firms that opened their offices in Kharkiv. They haven’t been particularly successful as yet, and regional specifics have nothing to do with it. The problem lies in the business models of top players — clients are unwilling to overpay for legal services (i.e. for double-checking of junior lawyers by senior ones and then partners and for procedural services; they do not wish to pay by the hour, etc.). The client wants faster, cheaper and more efficient work, so the number of legal start-ups and freelancers (independent lawyers) will only be increasing. And this does not only apply to the regions.

Do you feel upward pressure from internationalization of the demands made by clients in the region? If yes, what is the response?

Yes, over the past three years we have seen intensifying bilateral processes, particularly in the agrofood, IT and healthcare sectors.

Kharkiv is among the top 5 IT cities in Ukraine, so the number of international projects in this sector is on the rise: outsourcing companies are expanding their presence in other countries (USA, Europe), developers are bringing their products to international platforms such as AppStore and Steam, and foreign investors are trying to buy Ukrainian companies with narrow specializations, such as medical software.

International organizations (such as the EBRD, Konrad Adenauer Foundation and Invest in Ukraine) have opened, or are planning, to open their offices in Kharkiv this year. They chose this city as a base for their strategic presence in Eastern Ukraine. Also, with the support of the German Advisory Group and together with 20 producers and processors, we created the first agrofood cluster in Kharkiv, whose goal is to create and promote brand regional products in international markets. This is a good sign — competitive markets are emerging in Ukraine — which means that the legal market will also be developing, since the requirements of such clients for legal consultants are going to change.

In addition, international airlines, like LOT, Wizz Air, Turkish Airlines and others, are coming back to Kharkiv, helping the region to get fully integrated into the logistics map of Europe and, therefore, also increasing the number of international projects.

Other top industries generating legal fees are agrarians, energy and IT sectors. There is robust development of renewable projects over the past year and now too. The recent development of fintech determines demand on such a specific legal advisory. Other “fashionable” areas of advice are cryptocurrency regulations and cybersecurity.

The real estate sector also shows signs of revitalization. We observe a recovery in construction projects, asset deals, moderate renewal of real estate and construction finance. There is an expected uptick in infrastructure development, especially in port infrastructure.

In 2017 we saw a revival in debt capital market transactions and large scale restructurings (see Tables 1-3 for more details).

The year was marked by high-profile criminal cases. Declared state anti-corruption policy provoked a new wave of such proceedings out of corruption, money laundering, tax and other economic grounds.

A big chunk of work is about to come from e-declarations. Many law firms are trying to step up the offering in white-collar crime, admitting criminal defense attorneys to their teams. However, the top-end names here are boutiques and they remain consistent.

Law firms and legal units of the “Big 4” companies are highly active in nationwide reform projects that are often funded by international financial organizations. An increasingly big share of work is declared as pro bono work for the Government and NGOs, aimed at developing new and reforming already existent legislation. Herewith, many firms have announced the development of their government relations (GR) practices.

Referral Making. A Strategic Edge

Referrals facilitate cooperation between various competition tiers, across regions and countries. Good professional contacts became a competitive edge in generating business, and forward-thinking law firms put significant efforts on strengthening their referral networks.

New Names and Expansions

In May 2017a fintech consulting boutique called Brightman Law Firm was established by Dmytro Honcharenko and Krystyna Nyemchynova.

In June 2017 SDM Partners and Aronovych and Partners announced their merger. The amalgamated team operates under the SDM brand name.

Developing its practice in the Black Sea region, in August 2017 Interlegal unveiled an office in Varna, Bulgaria.

In November, Alekseev, Boyarchukov & Partners announced its merger with Trusted Advisors,and continued to operate under the brand of the former. Ivan Mischenko, former managing partner of Trusted Advisors, was appointed a judge of the Supreme Court. The position of managing partner was retained by Sergey Boyarchukov.

In December 2017 Ukrainian law firms Nobles and Phenomena started acting as one firm with five partners on board.

In the same month Konnov & Sozanovsky announced the strengthening of its intellectual property (IP) practice through merger with a boutique firm called ARTEX UKRAINE. Alexander Molotai became the head of the IP practice. Igor Baitsar has headedtheoffice in Chernivtsi, which operates in a partnership with Lexter Law Firm.

In December 2017 the Barristers Attorneys Association, with offices in Odessa and Kyiv, was established as the result of amalgamation of Ponomarenko & Partners and Shevchuk & Partners. The firm focuses on criminal law and process.

Starting from January 2018 part of the team from Spenser & Kauffmann, including three partners and six counsels, began its work under the new brand ADER HABER. Yuriy Petrenko became the managing partner.

Another part of the team continued to operate under the name of Spenser & Kauffmann, as led by Valentyn Zagariya.

In March 2018Interlegal opened an office in Constanta, Romania.

Staffing strategies

In February Sayenko Kharenko has strengthened its antitrust and competition practice with the hire of Oleksandr Nagorny, counsel.

In 2017 Dmytro Savchuk became an associate partner at Lavrynovych & Partners,and headed the practice of banking and finance following the departure of Olena Zubchenko to PrivatBank.

LCF Law Group has expanded its team with the arrival of new counsels Tetyana Ignatenko (litigation, ECHR practice) and Vyacheslav Shtuchnyi (business protection).

In June 2017 Victoria Fomenko left Dentons andjoined INTEGRITES as acounsel andhead of tax and customs.

Vadim Medvedev was promoted to counsel of tax practice at AVELLUM as of July 2017.

Redcliffe Partners strengthened its team by hiring counsels — Oleksandr Markov as head of tax and tax litigation, Daria Valyavska as head of IP, Svitlana Teush to develop energy and infrastructure practices.

In September Dmytro Donets joined the Attorneys Association PwC Legal as a partner and led the dispute resolution practice.

In October Volodymyr Pavlenko was promoted to partner and head of dispute resolution in INTEGRITES.

In November Vitaliy Odzhykovskyy joined Sayenko Kharenko as a counsel in tax practice.

In December Ilarion Tomarov joined Vasil Kisil & Partners as a counsel to head its IP practice group. He was previously employed at Taylor Wessing Ukraine.

Igor Lozenko re-joined Sayenko Kharenko as a counselof banking and finance practice.

In September Sytnyk & Partners announced the expansion of its litigation and criminal law practice with the appointment of Taras Olytsky as a partner.

At the end of 2017 Kateryna Tkachenko, partnerat competition law boutique CLACIS, left the firm to work in the public sector.

Starting from January 2018 Arthur Kiyan was appointed an associate partner in Lavrynovych & Partners.

Asters announced that Yaroslav Petrov has been promoted to partner effective 1 January 2018.

In the same month Dmytro Marchukov and Serhii Uvarov joined INTEGRITES from AVELLUM as a partner and a counsel, respectively.

Volodymyr Igonin, Oleg Kachmar and Anna Sisetska were promoted to partners in Vasil Kisil & Partners.

As part of Kinstellar’s 2018 promotions, the firm promoted Olena Kuchynska to partner and Mykyta Nota to сounsel.

Oleksiy Burchevskyy, who was in-house legal counsel in Wizz Air Ukraine, joined the Kyiv office and became the firm-wide head of the aviation sector.Spenser & Kauffmann announced the appointments of partners Nickolas Likhachоv (banking and finance, asset tracing, forensic) and Sergiy Pushko (dispute resolution), and Tamila Aleksyk,as counsel and head of the criminal law practice.

Asters expanded its industryfocused expertise with the addition of Yuriy Kotliarov (previously worked in Juscutum) as a partner in charge of the technology, media and telecommunications practice. Oleksandr Onufrienko joined the team as a partner focusing on the private clients practice.

The firm announced appointments of counsels — Olena Radko (M&A and corporate), Sergiy Tsyba (TMT), Sergiy Glushchenko (competition and antitrust), Oksana Legka (dispute resolution).

In February EQUITY announced the expansion of partnership and strengthening the practice of criminal law with the arrival of Yaroslav Zeikan and Olexandr Lysak.

Sayenko Kharenko announced three new counsels: Valentyna Hvozd (antitrust and competition), Sergiy Kazmirchuk (corporate and M&A) and Oleg Klymchuk (intellectual property).

In March 2018 Dmytro Donenko became a partner in ENGARDE.

Olexander Droug (international arbitration), Anton Korobeynikov (banking and finance, capital markets), Anzhela Makhinova (international trade), Oleksandr Nikolaichyk (corporate and M&A), Alina Plyushch (private wealth management) were promoted to partners of Sayenko Kharenko.

Dentons announced the promotion of four lawyers to the position of counsel: Oksana Horban (IP and technology), Nadiya Shylienkova (banking and finance), Maksym Sysoiev (energy), Anna Tkachenko (corporate and M&A).

GOLAW announced promotions in the firm: Max Lebedev (corporate)became a partner, Iryna Kalnytska (tax), Kateryna Manoylenko (dispute resolution), Anatoli Grabovy (commercial, civil and administrative law) and Igor Glushko (criminal law) have been appointed as counsels.

Maria Tsabal has joined AVELLUM as a counsel of finance practice.

In April 2018 ADER HABER appointed Oleksandr Udovychenko as a counsel in bankruptcy and financial restructuring.

Mykyta Polatayko (previously worked with Sayenko Kharenko) joined AEQUO as head of the IT industry group.

Oleg Matiusha (previously — DLA Piper) joined the Kyiv office of Kinstellar as counsel and head of the local real estate practice.

In May 2018 Kateryna Oliinyk, head of intellectual property at Arzinger,received a promotion to partner.

Illya Sverdlov, head of tax, became a partner in the Kyiv office of DLA Piper.

Andrii Romanchuk became a partner of International Legal Center EUCON, and head of its corporate practice. Yuriy Chebotar, involved in transfer pricing advisory, and Artur Shevchyk, practicing tax planning, became counsels in the firm.

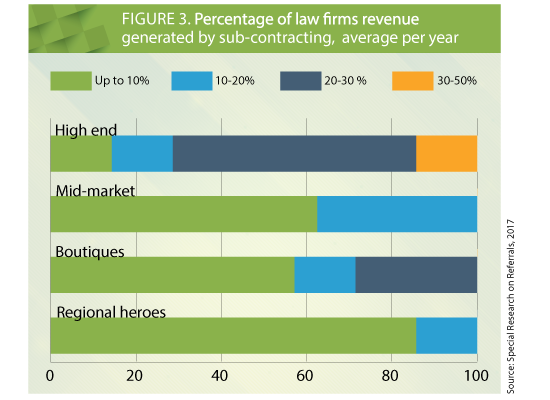

According to a special survey dedicated to referrals1, the average percentage of law firm income generated from sub-contracting varies from one segment (tier) to another (see Figure 3). The high-end market works closely alongside international law firms on multi-jurisdictional mandates. The mid-market and regional counsels are less affected by referrals. Boutiques are traditionally possessed as a well-referred business, since one quarter of them can generate around 20-30% of their income from sub-contracting.

The monitoring of incoming and outcoming referrals is a well-established practice adapted in high-end firms. Notably, this practice is very useful in terms of strategic development and client proliferation, exploring competition. And we have some good news. After our research some of the respondents decided to introduce referral records and have already shared their positive experience with us.

Reciprocity is probably the core advice for starting to consider a referral strategy. Other efficient workable tools are personal meetings and road shows, international networking events, communicating a good reputation and developing international networks.

Interesting statistics emerge from the average percentage of other law firms in the client profile (see Figure 4). This figure is around one quarter for the high-end market and boutiques. Curiously, there are modest results for the mid-market (7%) and regional counsels (9.2%).

The referral and/or subcontracting of the mid-market appeared to be not financially efficient for other tiers of law firms. However, following internationalization of client needs, the mid-market is demonstrating high-rise efforts to establish contacts with other independent law firms in certain jurisdictions.

There are several explanations for the low cooperation in the regions. First, the core factor is a lack of the required expertise and quality. Second, according to high-end players, sometimes prices could be compared with those in Kyiv (depends on the region).

The research definitely facilitated interest towards referrals in the professional community. Our team is proud to provide insight and “food for thought” for strategic thinkers.

Points of Change

The coming changes in the legal market are anticipated from the gradual introduction of the so-called “attorneys’ monopoly” when only attorneys are able to handle representation in courts. Thus, the bar will be increasingly populous, and the role of the attorneys’ community apparently becomes stronger.

The reform of the country’s judiciary is still in progress, and market insiders are predicting a continuous outflow of practitioners from the legal business to the courts for judges’ posts. And vice versa, a series of comebacks of public officers to the private legal market has already begun.

The coming years are centered on hopes on growth in the M&A market. Changes in corporate legislation may cause more demand for corporate and business restructuring projects. Recent changes in privatization law and a critical need to improve the efficiency and modernization of state assets are expected to be sufficient grounds to finally launch a nationwide privatization. The increased number of international arbitrations involving the State of Ukraine and national corporations will generate work for arbitration and litigation practitioners. After transfer pricing audits a new area of TP disputes will receive grounds for development.

Industries may undergo significant regulatory changes, provoking demand for sector-specific expertise and focus on technical legal issues.

Mirroring the broad trend towards disruptive innovations, the active implementation of IT technologies in basic legal services is only a matter of time.

Big international investors and, as a result international law firms, will be interested in the Ukrainian market when the country can offer investors the benefits of a stable economy. This is the key precondition for rebooting transactional practices, and thus lawyers continue to lobby for an increase in investment attractiveness and convenient conditions for capital.

1 The findings of special research on referrals were presented by Olga Usenko at the International Forum for the Promotion of Legal Services and published in the Yuridicheskaya Practika (Legal Practice) Weekly: http://pravo.ua/article.php?id=100116817